MONEY, MONEY, MONEY

LP STUDENTS OPEN THEIR WALLETS TO REVEAL FINANCIAL HABITS AND CONCERNS

April 24, 2023

With inflation on the rise since 2021, many Americans can no longer afford the necessities they used to purchase without second thought. As it happens, students aren’t exempt from these financial worries.

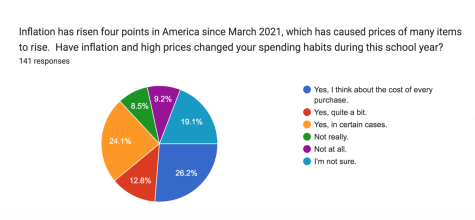

At Lincoln Park, nearly two-thirds of students surveyed admit that inflation has caused them to alter their spending habits.

Senior Bethany Kirk, a theatre major from Pittsburgh, says, “I’d say that due to the higher prices as of recently, I’m more conscious of my spending, trying to buy generic brands, limit who I’m buying from and making sure I’m not buying excessively or wasting gas and food.”

The SIREN recently conducted an economic survey of nearly 150 students from all grade levels. The goal was to track student spending habits, learn more about their employment, and find out their thoughts and worries about their financial future.

The survey showed that more than a quarter of students said that they now “think about the cost of every purchase.” Nearly 13 percent of students said they think about the cost of purchases “quite a bit,” while an additional 24 percent said inflation has made them consider costs “in certain cases.”

INFLATION INCREASES PRICES; THRIFTINESS

Aleya Goode, a health science senior from Moon, says, “Yes, I’m very conscious on what I’m spending my money on and when I’m spending it, how much I’ll have after, etc.”

Music major Skyler Silver, a senior from Beaver, adds, “It doesn’t really stop me from spending money on what I want, but it just makes me pissed off when I look at the receipt.”

Although inflation has decreased recently to about 5 percent, John Williams, the president of Federal Reserve Bank of New York, said last Wednesday that inflation is still a problem.

“Inflation is still too high, and we will use our monetary policy tools to restore price stability,” Williams said in a speech at New York University.

Mason Milkovich, a health science major from Midland, says, “I’ve had to really watch how much I spend because of price increases on a lot of normal everyday necessities.”

COUNTING THE CAR COSTS

Of the 56 students of driving age in the SIREN survey, 29 percent use the car of another family member to drive. Ten percent own their own car and do not make payments on it, while another six percent either help with car payments, or make them all themselves.

When it comes to filling the tank of those cars, 14 percent of student drivers spend between $20 and $40 a week on gas. Another 17 percent spend more than that–a few indicating that they spend more than $75 a week on gas.

The average price of gas across Pennsylvania recently rose to $3.75 a gallon–a 7.5 cent per gallon increase over the past week.

Senior Hanna Herrmann, a theatre major from Mars, says, “Gas prices are insane. I spend, like, 50 dollars a week just to get to school, and it’s horrible.”

Theatre major Dylan Stramaski says he sometimes drives to school: “It all depends on what’s going on.”

“So if I’m in shows or I’m helping out with an activity for a club or something, I will, but not every day because I’m broke,” says Stramaski, a senior from Munhall.

However, despite the high cost of gas, some students say driving to school is still worth it.

“Definitely, the buses are cramped and loud and I’d much rather drive to school,” says junior music major Natalie Young of Conway.

Hannah Herrmann agrees.

“Because I have rehearsal after school every single day, and my mommy doesn’t want to come pick me up at 9 p.m. every single night,” Herrmann says. “So I drive, and almost fall asleep all the time.”

Owning a car “would depend on your financial situation,” adds Mason Milkovich. “If it’s possible for somebody, I think it’s definitely worth it and having access to a car in general is worth it.”

TAKE THIS JOB AND SHOVE IT?

The SIREN survey showed that almost half the high school-age students surveyed — 42 percent — said they have full- or part-time employment. And a third of those students said they also have a second job.

An almost equal number of high school students — 45 percent — reported that their employment is their primary source of income. But not everyone is happy about working.

Pre-law senior Georgia Williams of Moon says working in high school is not worth the hassle.

“Not at all. It affects my mental health and grades far more than it helps me,” says Williams. “It seems like I have missed out on so much of the high school experience because I have to work. I have to work because I have to afford gas.”

Almost half the students who work — 42 percent — reported that they make between minimum wage — $7.25 an hour–and $15 an hour.

Twelve percent of high school students surveyed said they make between minimum wage and $10 an hour. Another 21 percent make between $10 and $12.50 an hour, and another 10 percent make between $12.50 and $15 an hour.

Bethany Kirk, who stopped working because senior activities kept her too busy, adds, “If you have the privilege of not having to work in high school, I’d recommend that you take advantage of it. Having to work provides a lot of extra stress and time consumption.”

Even some students who aren’t working now acknowledge that having a job can be beneficial.

Natalie Young says, “I used to work two jobs. The last four months I’ve been unemployed, though. It’s good to have money and be able to sort of be financially independent.”

UNCERTAIN FUTURE

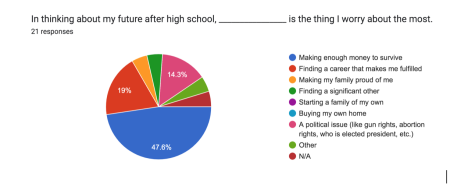

When asked the question, “In thinking about my future after high school, ________________ is the thing I worry about the most,” nearly half the seniors surveyed answered, “Making enough money to survive.”

That concern is shared by more than just soon-to-be-graduates.

Junior music major Randall Clow of Hopewell admits he’s torn about his future prospects.

“I honestly don’t know how to feel about my economic future,” says Clow, “because I think I need more time to find out where I stand in it all.”

Junior Natalie Young is similarly ambivalent. “With the way inflation has been affecting the economy the last few years I can’t say I’m too optimistic about my own future,” she says.

“I have hope that things may get better,” Young adds, “but overall, I’m not very optimistic.”

There are some students, however, who believe they can overcome the current economic uncertainty.

“Being that I have worked for much of my life, I believe I have a steady understanding of money management and the economy,” says Bethany Kirk. “I think this has helped me and will continue to help me build a stable fountain of monetary value.”

Georgia Williams adds, “I do worry, because everything is getting more expensive. But I also think that I will figure it out eventually.”

HOME AND HEARTH

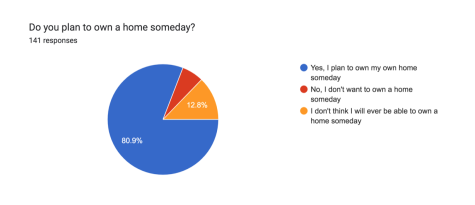

The SIREN survey did show optimism in some areas. Nearly half said they hope to start a family some day. And more than 80 percent of respondents said they plan to own their own home. Only 13 percent of respondents said they don’t think they’ll be able to own a home.

The question still surprised some younger respondents.

When asked about home ownership, Liv Poole, a freshman theatre major from Midland, exclaims, “Whoa — I wasn’t expecting that question! Sure, yes, someday.”

Survey respondents were also asked what kind of career they are most likely to choose. More than half — 55 percent — said they planned to choose a career they loved, no matter the pay.

Nearly a quarter of students, however, said that they would choose a high-paying career, no matter what kind of job it involves.

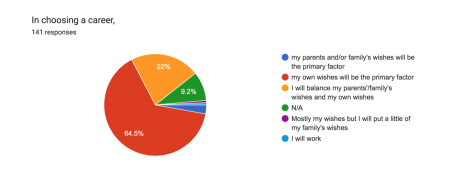

When it comes to picking that career, most students — about two-thirds — said their wishes would be the deciding factor. Another 22 percent said they would try to balance their own career plans with their parents’ and family’s desires, and only three percent said their family’s plans would decide their career.

But for younger students, that future is still some ways away.

“As of now, I want to do something that I like to do,” says Poole. “But in four years, maybe I’m gonna do something more practical. I don’t know, we’ll see.”

Tune in later this week for more results from the SIREN Economic Survey!